Escaping Debt Mountain

2021-04-02

Disclaimer: I'm not a financial professional. If you've been given advice contrary to mine, take it. My advice might be bad for you. We're not filthy rich or anything.

In 2010, student loan debt exceeded credit card debt in the United States.

My wife and I were no exception; all told, we had ~$110,000 in loans. We graduated in 2011, but due to deferment and standard lead times, we didn't get the bill until sometime in 2012. Most of the loans were private, some with interest rates over 10%. I remember very clearly when the first monthly bills came; over $1100.00 all told, more than our rent by nearly half. It was devastating. We had dreams for our lives together; weirdly, none of them were "let's pay down loans until we're fifty!"

Here's how we paid them all off by 2017.

Budgeting

I started budgeting in a sort of strange way; I bought a sports car.

In 2014, we went on a road trip; we rented a convertible and drove down the Pacific Coast Highway from Portland, OR to Los Angeles, CA, stopping at Fort Bragg and San Francisco along the way.

I decided I wanted a convertible; I started poking around on craigslist, looking at this or that; one day, a silver Audi TT caught my eye (it had AWD, so it was sensible for Pittsburgh, obviously). It was $18,000! I really didn't think I could afford that, but my wife encouraged me to go for it, if it fit my budget.

It was at that point that I realized I didn't HAVE a budget. I didn't have any idea where my money was going.

I sat down and figured out my income and my bills, and realized that the payment actually wasn't out of reach. A week later, I was driving my new (well, 2008) Audi home.

As you can see it was immensely practical.

(Funny story: I didn't know how to put the thing in reverse. I drove it straight to work, where all my coworkers gathered around the window, watching me drive it around the block three times before I caught a long enough break in traffic to look up how to do it [push the shifter down, thanks VW]).

(Additional funny story: I was so paranoid about it getting scratched or costly repairs that I sold it a year later for about half what I paid. Oof.)

Budgeting was an unbelievably empowering exercise. Before, I was constantly nervous about money I was spending - could I really afford this dinner? These clothes? This trip to see friends? Having a budget gave me a concrete understanding of where my money was going and was the key to putting our debt repayment into high gear.

There's great software out there to manage financing; Budget Simple, Mint, and YNAB to name a few. I have no strong recommendations; the budgeting software that you use is the superior budgeting software. Borrowing a expression I learned from my friend Matt:

"Hike your own hike"

In terms of how you structure your budget, here's my (also borrowed!) rules:

- Pay your loans/obligations ASAP - if you want to lower your debt, figure out what you can eke out each month and pay it as soon as the money hits your pocket.

- Expect to slush a bit and don't be mad about it. I would often "borrow" from other line items to fund things like beers with friends. That's totally okay, so long as your hitting your savings/debt payment goals.

- Simpler is better. Tools like Mint encourage you to over-categorize your expenses, but the "good feeling" you get from doing that is pretty flimsy. I found it much easier to stick to a budget with limited line items then highly granular budgeting where every expense was forecast.

- Overall, be kind to yourself. Life is short, things happen. If you're not actively self-sabotaging, you're still doing your best.

To make a budget, you'll need to figure out what your income and expenses are; If you do shift work and make tips, start tracking how much you earn and average it out per day. Figure out your fixed expenses: rent, utilities, debt. Subtract the two; if you're spending more than you're making, figure out how to make those two meet. Here's my "starter budget".

Once you have a budget setup, save up an emergency fund. An emergency fund is cash in your savings account that can cover at least 3 months of expenses, and ideally 6 months. Now that you have a budget you know exactly how much that is!

I can't stress enough how important emergency funds and budgets are; they will completely change your relationship with finances. You'll no longer have to stress about unexpected bills, and you can splurge guilt-free because you've planned ahead.

Debt Forecasting

Once you've got your budget figured out, it's time to tackle the debt. There are two popular strategies for paying down debt: snowball and avalanche. Both of these involve progressively paying off loans and rolling the payments you would be making into the loans you haven't paid off. For example, if you're paying $200 a month on Loan A and $300 a month on Loan B, once Loan A is paid off you'd start paying $500 a month on Loan B.

The difference is in which loans you prioritize; the "snowball" strategy says you should pay the smallest balance loans down first, then proceed onto the progressively larger loans. The "avalanche" strategy says you should instead pay the highest interest loans down first, and proceed in the same fashion as snowball.

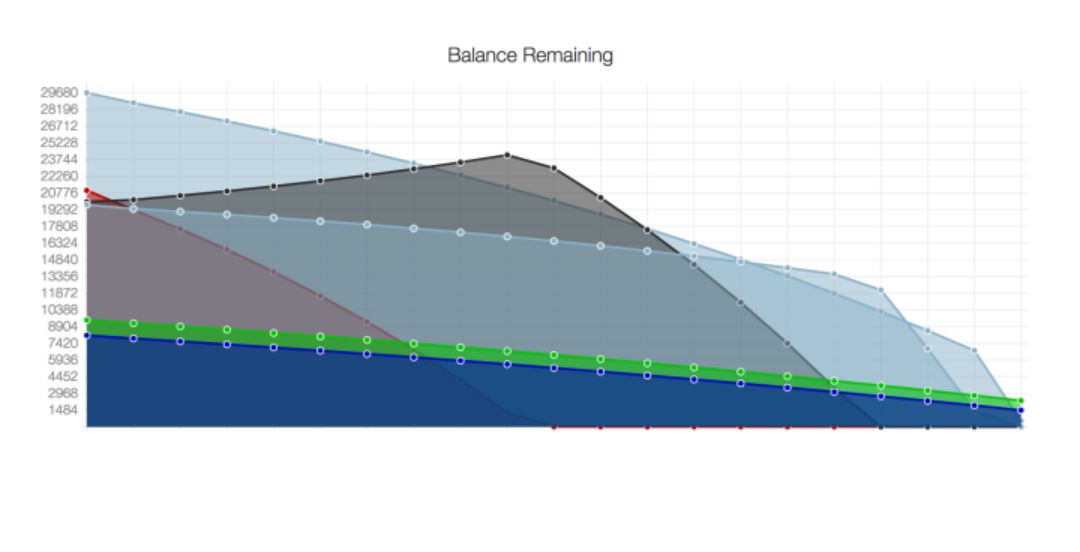

A great tool to visualize and understand this is unbury.me. I'm not exagerrating when I say this tool changed our lives; it allows you to plug in the numbers for your loans, then start playing with things ("what would happen if we paid an extra $50?"). When we first did this, here's what things looked like (a.k.a. "Debt Mountain"):

| Avalanche (min) | Minimums Only | |

| Payoff Date: | May 2030 | April 2043 |

| Total Cost: | $162,993.97 | $286,565.80 |

Because the entries are all saved in the URL, you can bookmark it and save your progress (or copy links to your spreadsheet, which I did!). Try feeding it some ridiculous numbers and look at your total savings in interest; ask yourself, is that number really all that ridiculous? Could you make it work?

Spending Less

Once you've got an idea of what you need to spend, you can start considering ways to come up with that money. A common refrain here is "earn extra income!". Frankly, I think that's pretty unrealistic, and mostly a line folks feed you to join their crummy multi-level marketing schemes. Don't get me wrong - extra income is great, it's just unreasonably hard to come up with if you're already working. Alternatively, lowering expenses is usually much more feasible, so I suggest starting there.

Note: this is not about punishing yourself. It's also not about avocado toast or Starbucks; it's about planning. During this time, we went out to dinner, had drinks with friends, took vacations; our lives were not dimishished.

Here are my suggestions on how to eke out some extra bucks, in order of radical-ness weighted by impact.

Warning: none of this is sexy.

- When starting a new job, no matter the offer, ask for more. You're never going to get a few thousand bucks for working extra hard, but you absolutely can by saying one magical sentence to the hiring person: "This is close to what I need, we're almost there; could you do $NUMBER + $2000?" I've given this advice many times; it always works.

- Switch to a low-cost mobile carrier; we use Mint Mobile and pay ~$40/mo in total.

- Call (or message) your cable company and ask for a lower bill; you'll be shocked how often they'll trim a few bucks off.

- Cut the cord - cable subscriptions are VERY expensive, get a Netflix subscription or become a YouTube junkie. Our internet costs $50-60 a month depending on the deal I've wrangled.

- Store brand everything, especially pharmaceuticals. There's no reason to buy Tylenol; they're legally required to produce the exact same drug as the generic acetaminophen.

- Decide your bar tab before walking in (preferably by taking out a set amount of cash) It's surprisingly easy to keep it under $20 with tip if you commit!

- Meal prep! Cook batch foods that freeze well for lunches/dinners during the week. I'm a huge fan of red beans and rice. Googling "cheap healthy recipes" will change your life.

- Buy clothing second-hand (also great for the planet) - I buy nearly all my clothes at Goodwill or Clothes Minded.

- Buy used cars. I'm a diehard used Toyota Camry fan. We've driven the same 1997 Lexus (it's a Toyota in all but name) for the past five years and spent less than $1000 in repairs and maintenance. Insurance is $400/year. (Side note: the look on someone's face after I've told them I drive a Lexus and then they see it is absolutely priceless.) DON'T BUY OR LEASE NEW CARS, YOU'RE BEING MANIPULATED.

- Go down to one car - save on insurance, maintenance, gas etc!

- Assume you're the statistic! Any time an idea like "I should buy a boat" floats into your head, do the bare minumum research to see how bad of an idea that is and don't let your brain trick you into thinking your somehow better than that. You are human, susceptible to manipulation, and definitely not going to go sailing all summer.

- Live in a second-tier city! Pittsburgh is far from glamourous, but every time I go back to NYC I can make it rain on my friends who live in cramped apartments deep in the outskirts of the city. Shout out to Joshua Kennon who taught me that lesson when I was a tech PR intern!

- Learn how to negotiate! Ask for more (or less!), and be in a position to walk away.

- Start biking! You can save a small fortune* biking around the city and you'll be healthier and happier. (*you'll almost certainly blow more on fancy bikes)

- Buy a house! Yes, seriously! In many places the break-even point for buying-versus-renting is only a few years; statistically speaking, you're likely to spend at least 7 years wherever you're at now. When you pay a mortgage, you're going to get that money back when you sell, plus equity; when you pay rent, you're throwing money away. The New York Times has a great breakeven calculator. For our part, we specifically bought to lower our monthly "rent" and put that money towards debt.

- Move to Australia! Seriously, the cost of living is quite high but the minimum wage is also very good; if you can rough it for a few months doing seasonal work, you could put a substantial dent in your debt (note: we didn't do this)

- Work remotely from a country like Thailand! The cost of living there is absurd; leverage that for higher payments on your debt (note: we didn't do this).

Prioritization

Boiling down some of the above, here's how to prioritize your money going forward:

- Take advantage of any "free money" you can - if your company offers 401k matching, take it to 100%. That's a 100% ROI, which you won't get on anything else ever!

- Save your emergency fund - once you have that, you have freedom.

- Pay down any debt with greater than 3% interest, avalanche style.

- Max out your 401k, then start looking into other investing options (we're here)

Closing Thoughts

So how did all this go? Well, my numbers are probably imperfect, but:

| Payoff Date: | December 2017 |

| Total Cost: | $123,421.27 |

| Savings: | $39,572.70 - $163.144.53 |

On the one hand, I'm super proud of us and what we accomplished. It took a lot of discipline and hard work to achieve our goal. It was 100% worth it, too.

On the other hand, many of the systems that yoke people with debt are cruel and unfair. We really didn't understand what we signed when getting our loans; we also had literally eighteen years of people telling us that if we didn't go to college we were failures, and then four years of rosy employment and salary figures to temper any concerns (I was told I'd make $70k out of school... my first job offer was **$30k *IN MANHATTAN***).

It's unfair and disappointing that debt, partcularly non-dischargeable student loan debt, has become such a central part of the story of an entire generation. For that reason, I don't take pleasure in writing this "guide" (aside from pride at having made it out). To that end, we both support student loan forgiveness, among other debt relief measures, and you should too.

It's also unfair to leave out how this was all possible; we got unreasonably lucky. We found a very cheap house, fell into successively better paying jobs, and Pittsburgh has remained affordable while cost of living in other cities have exploded. It's ridiculous that all of those things have to go well in order for two people to live without ruinous debt.

Good luck! I hope you find peace on your financial journey.